When working prospective Act 20/22 decree holders, one of the most important stakeholders in the process is the client’s CPA. With the knowledge of the client’s current position and future goals, the accountant will be able to identify opportunities and challenges unique to the client. Since an advisor’s recommendation requires proper due diligence, the consulting division at CASPR works together with client CPA’s, Puerto Rican financial professionals and the government to deliver results through a team-based approach.

In 2012, Puerto Rico wrote two new laws to increase economic development by providing incentives for businesses (Act 20) and individuals (Act 22) to relocate to the island. Right from the start, preliminary decisions are based around which acts to pursue. Some opt for only Act 20, some for Act 22 only and the majority opt to use both acts in tandem.

As this topic is geared towards a technical audience, if you would like to learn more about the basics of Act 20 and Act 22, please click the respective links for a general overview.

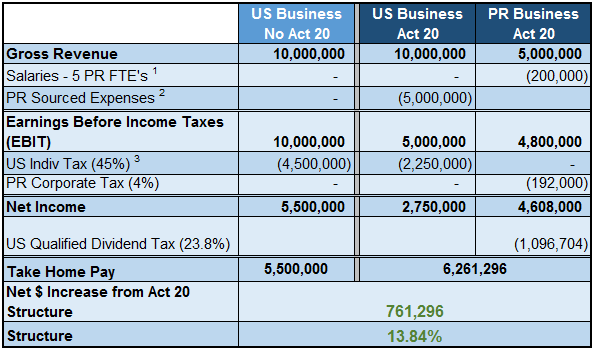

TRANSFER PRICING UNDER ACT 20

Some Act 20 businesses will operate in a similar structure to the following example using a law firm. An LLP with 10 partners moves its headquarters to Puerto Rico and partners continue to reside in Manhattan. Per Act 20 requirements, the new Puerto Rican corporation hires five employees over a two-year span, performing all back office functions for the New York firm. Services such as accounting, IT, HR and legal work are billed at an arm’s length, triggering additional tax-deductible business expenses for the New York firm from the Puerto Rican entities export services. Although, the business does not source 100% of the income out of Puerto Rico, over time, dividends start to accumulate in Puerto Rico. What was once ordinary income to the partners, is now a qualified dividend, taxed at preferential rates.

The Graph below outlines the net benefit of over 13.84% per year achieved through strategic planning using Act 20.

UNDERSTANDING ACT 22 INTRICACIES

At first glance, the benefits of Act 22 seem like a free for all. Statements such as “Move to Puerto Rico and pay no tax” are far from the truth. Along with the requirements of qualifying under Act 22, there is an entire rule book on how the act actually works. We will hit on the highlights by examining the three following asset types –previously held, new acquisitions and future disposals.

Assets owned by Act 22 decree holders prior to establishing residency in Puerto Rico will not be completely tax free. Once an Act 22 officially moves to Puerto Rico, all assets need to be valued to establish a Puerto Rican basis. Gains earned as a Puerto Rican resident are not subject to tax.

Once residency is established, capital gains and Puerto Rican sourced distributions are tax free. This is important as most Act 22’s also have an Act 20 business. This structure creates one of the most cash flow efficient models in the world. Dividends and interest payments from US corporations will likely be subject to US tax. Although, these same payments yield 0% tax if invested through a Puerto Rican fund. Typically, CASPR clients work through large investment management firms on the island – Goldman Sachs, Merrill Lynch and UBS are some of the large players.

In consideration for the future, it is important to know that once an individual is a Puerto Rican resident for 10 years, there is additional preferential tax treatment. Upon that anniversary, all gains earned prior to establishing Puerto Rican residency will be subject to a flat 5% tax on that specific part of the gain, nothing to the US and nothing to Puerto Rico. Conversely, if one decides to sell an asset before the 10-year period, the amount of the gain owed to the IRS is calculated by multiplying the total gain against a ratio between how many days the asset was held and how many days it was held as a US resident.

Being able to articulate these two important details for Act 20/22 are a step in the right direction to becoming an expert in these specific tax incentives. With proper consultation and planning, these Act 20/22 can help clients keep more of what they have worked so hard to create.

This text is intended to be informational in nature. Please contact a member of the CASPR team if you have any questions.